The EIA's latest short-term outlook offers some good news on gas prices where at the pump drivers have been pummeled in recent years by the prior Administration's focus on forcing gasoline engines off the road and stopping oil production and refining.

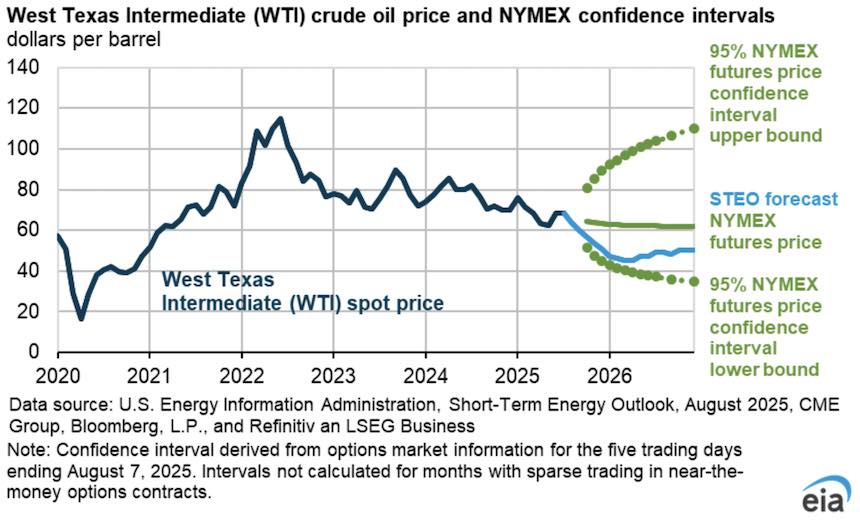

According to the Agency's latest forecast, oil prices are set to decline as inventories build.

"The Brent crude oil price in our forecast declines significantly in the coming months, falling from $71 per barrel (b) in July to $58/b on average in the fourth quarter of 2025 (4Q25) and around $50/b in early 2026," the EIA said.

That's good news for drivers, since lower oil prices eventually find their way to the gas pump as well.

The International Energy Agency's August Oil Market Report bolstered the forecast from the EIA, noting that oil supply was outrunning demand globally. The IEA expects this trend to continue through next year, it said, "as forecast supply far eclipses demand towards year-end 2026.

This should mean relief at the pump, said the EIA. "Lower crude oil prices push down retail prices for petroleum products in our forecast. We expect the price for retail gasoline across the U.S. will average less than $2.90 per gallon (gal) next year, about 20 cents/gal (6%) less than this year."

For natural gas, widely used for home heating in the U.S., the story is not as good. Due to increases in US exports of liquified natural gas without corresponding increases in production, supplies are tightening.

"We expect the Henry Hub natural gas spot price will rise from an average of $3.20 per million British thermal units (MMBtu) in July to $3.90/MMBtu in 4Q25 and $4.30/MMBtu next year," EIA said. "Rising natural gas prices reflect relatively flat natural gas production amid an increase in U.S. liquefied natural gas exports."

Also putting pressure on consumers and homeowners will be the likelihood of continued increases in the price of electricity as demand continues to increase, something the EIA said is impacted by the number data centers -- mostly for AI -- coming online.

"Electricity demand growth in our forecast is driven by the commercial and industrial sectors," EIA noted. "We expect electricity sales to the commercial sector to rise by 3.0% in 2025 and 4.5% in 2026, driven largely by more demand from data centers, while electricity sales to industrial consumers rise by 2.0% in 2025 and 3.5% in 2026."

The increases in demand are leading to large increases in prices paid by consumers in some states. Accorinding to Gizmodo, citing a report in Axios, consumers in Maine have seen prices for electricity increase by over 36 percent. Maine is not alone, though its increases have been the most dramatic.

One report, from the Institute for Energy Economics and Financial Analysis, noted that price increases for 2025/26 driven by data center demand "translates to $9.3 billion in costs that will be recovered from customers...in higher electric areas."